Maelstrom Fund Shifts Strategy: High-Risk Bets on Altcoins for 2026

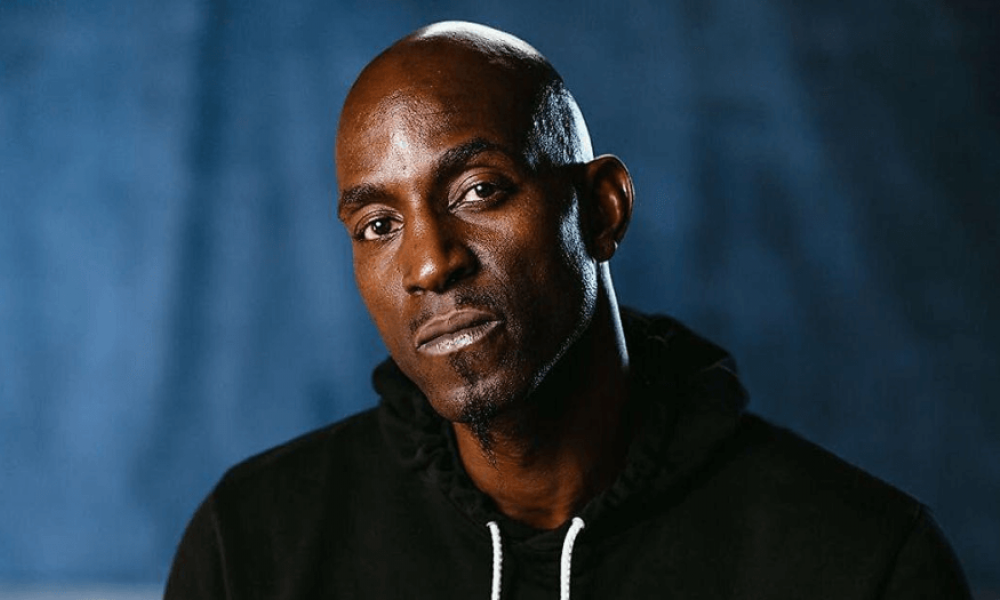

The Maelstrom investment fund, spearheaded by Arthur Hayes, is beginning 2026 with a strategy described as ‘almost maximal risk,’ continuing a previously adopted aggressive approach and minimizing exposure to stablecoins.

In a recent essay, Hayes stated that Maelstrom remains deeply invested in speculative assets, with a sharpened focus on cryptocurrencies prioritizing privacy, specifically Zcash, and emerging decentralized finance (DeFi) tokens. ‘Maelstrom entered 2026 with almost maximal risk,’ Hayes noted. ‘While we will continue to invest Bitcoin from proceeds of various financial transactions, our dollar stablecoin holdings are very low.’

This shift represents a significant divergence from Maelstrom’s early 2025 position, where Hayes predicted a Bitcoin price drop to $70,000 should a ‘mini-financial crisis’ occur, anticipating a subsequent quantitative easing period. Following a reduction in risk and increased fiat holdings in January 2025, the fund quickly escalated its risk profile, establishing its largest direct cryptocurrency exposure in April amidst a temporary Bitcoin dip below $85,000.

As the year progressed, the fund maintained this elevated commitment to cryptocurrency assets, particularly those focused on privacy, which Hayes believed were being acquired at advantageous prices. In December, Hayes declared it was ‘time to buy,’ citing declining interest rates and expanding Federal Reserve reserves, and affirmed the fund was ‘actively accumulating.’

Hayes, widely regarded as one of the most influential macroeconomic commentators in the cryptocurrency sector, now anticipates that the ongoing macroeconomic scenario – including projected nominal GDP growth, U.S. fiscal deficits, and potential Federal Reserve monetary easing – will drive crypto prices higher. He believes this liquidity surge, partly fueled by geopolitical events like U.S. intervention in Venezuela, will particularly benefit riskier investments in lesser-known tokens, assuming continued U.S. credit injections to curb oil prices.

Maelstrom’s 2025 performance yielded profitable, albeit uneven, results, fueled by strong returns from tokens like BTC, HYPE, and PENDLE, alongside costly errors with assets like PUMP. Looking ahead, the fund intends to prioritize credible scenarios supported by broader liquidity trends.

Recent developments include River, a blockchain-based stablecoin startup, securing strategic investments from Maelstrom, although specific financial details remain undisclosed.